Content

Any amount paid to the account during the period is shown on the statement, as well as any amount that remains unpaid for the billed period, and the billing cycles preceding the current cycle. At N26, you can track your financial activity as often as you want—hourly, daily, or weekly! Easily view transactions via your mobile or web app—and rest assured that all your bank statements are securely and safely stored for your peace of mind. Bank statements include highly personal information, such as your name, account number, and address.

Even better, with our fully customizable templates and the ability to include your business branding, you can add in a level of personalization that will give your business that extra edge. Be sure to include all the relevant information so the customer can make their payment as quickly as possible. Account statements show the transactions between a buyer and a seller. This includes the name of businesses, contact information of the buyer and seller, email and phone numbers.

Rocket Lawyer members who started a free Statement of Account also made:

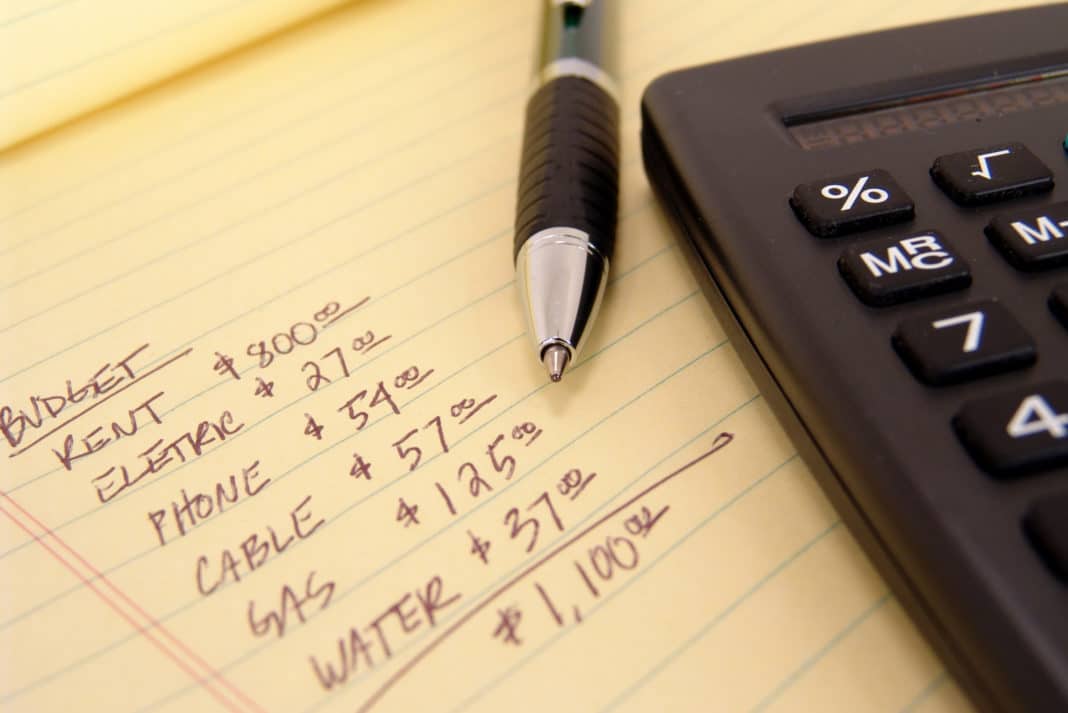

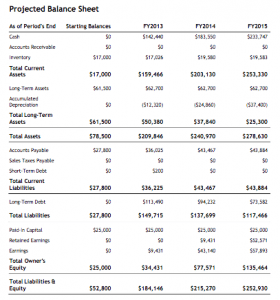

The most commonly known are checking account statements, usually provided monthly, and brokerage account statements, which are provided monthly or quarterly. A statement of account, or account statement, is issued by a vendor to a client. It lists out all the financial transactions between the two businesses within a specific time period . The statement may reflect a zero balance, if not, it acts as a reminder to the client that money is due. The statement is a written record of any balance at the beginning of a time period, any new invoices issued or payments received during the time period, and what is still owed. Account statements should be scrutinized for accuracy, and historical statements are critical for budgeting.

To view your statements, open your home screen and click through on the three horizontal bars, then tap the ‘Balance Statement’ tab. Log into your N26 account today to get accessible reports in just a few taps. Using your bank statement to review your spending habits is a great way to help you identify possibilities for saving. Looking at a full overview of your spending gives you the chance to see where you could stand to cut back or tweak your spending habits. An NSF fee or non-sufficient funds fee is incurred when a bank account does not have enough money to cover a payment.

How can I create a statement of account?

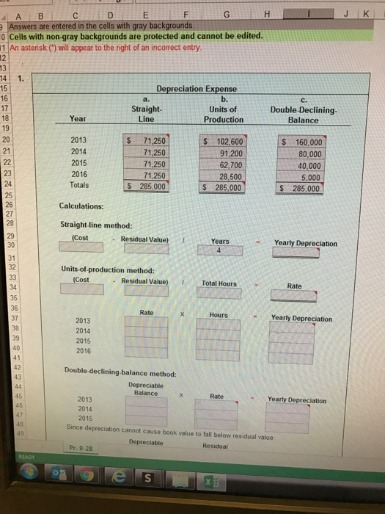

An account statement can have additional columns such as document type, document status, and so on. With account statement configuration, you can configure the properties of additional data columns that are explicitly included in the account statement. Some financial institutions use the occasion of posting bank statements to include notices such as changes in fees or interest rates or to include promotional material. Whichever method you choose, time buckets can be a helpful way to keep track of your accounts receivable – and help your customers stay on top of their payments. For example, the amount owed may include additional costs such as penalties for delayed payments, interest charged on the debt owed, overdraft fees, double charges, etc. The additional costs increase the total amount owed, and the customer may require these costs to be reviewed to reduce the debt burden.

This statement contains a list of all invoices created within that time frame. A statement of account captures the financial transactions between the two companies during a specific period of time, usually a one month period. The statement of account may show an amount still owing by the client. Similarly, online payment processors such as PayPal allow customers to access credit card statements for any specific duration that the customer is interested in. Any cash payments in and out of the account are shown in the statement, and the ending balance shows the current account balance at the end of the period. Where a sales invoice is a bill for one transaction only, a statement of account definition refers to the complete list of all invoices attached to that client within a stated period. This document is handy for both small businesses and their clients, as it shows the monthly transaction history and account activity between the two, all in one place.

Meaning of statement of account in English

The statement shows debits paid to the account, credits received, account maintenance fees, state taxes, and any surcharges included in the account. Reviewing your bank statements regularly can help you spot any unauthorized payments on your account so that you can flag them to your bank right away. With N26, you can enable push notifications whenever a transaction takes place on your account, so that you can quickly spot any suspicious activity. At the top of the https://business-accounting.net/ statement, you’ll usually find your account number, the bank branch provider, your full name and home address, as well as the beginning and ending period of the statement. Next, you’ll find the full list of transactions made within the statement’s timeframe—essentially all payments that came into your accounts, and all outgoing payments. Each transaction will show the date it was processed and may also include some information about who the payment was to or from.

At N26, not only can you quickly and simply access your transaction information via your smartphone, you can also download your statements in PDF form. Money market account is an interest-bearing account at a bank or credit union, not to be confused with a money market mutual fund. As an optional item, a statement of account can have a note to the client, indicating that this is not a bill but a statement.